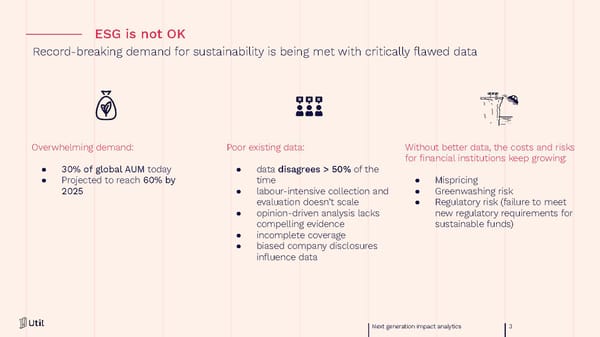

ESG is not OK Record-breaking demand for sustainability is being met with critically flawed data Overwhelming demand: Poor existing data: Without better data, the costs and risks for financial institutions keep growing: ● 30% of global AUM today ● data disagrees > 50% of the ● Projected to reach 60% by time ● Mispricing 2025 ● labour-intensive collection and ● Greenwashing risk evaluation doesn’t scale ● Regulatory risk (failure to meet ● opinion-driven analysis lacks new regulatory requirements for compelling evidence sustainable funds) ● incomplete coverage ● biased company disclosures influence data Next generation impact analytics 3

Util Page 2 Page 4

Util Page 2 Page 4