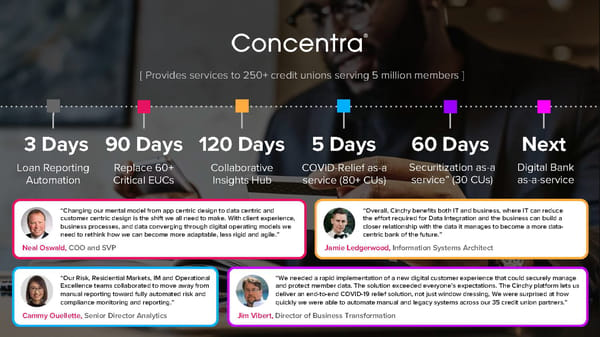

[ Provides services to 250+ credit unions serving 5 million members ] 3 Days 90 Days 120 Days 5 Days 60 Days Next Loan Reporting Replace 60+ Collaborative COVID-Relief as-a Securitization as-a Digital Bank Automation Critical EUCs Insights Hub service (80+ CUs) service” (30 CUs) as-a-service “Changing our mental model from app centric design to data centric and “Overall, Cinchy benefits both IT and business, where IT can reduce customer centric design is the shift we all need to make. With client experience, the effort required for Data Integration and the business can build a business processes, and data converging through digital operating models we closer relationship with the data it manages to become a more data- need to rethink how we can become more adaptable, less rigid and agile.” centric bank of the future.” Neal Oswald, COO and SVP Jamie Ledgerwood, Information Systems Architect “Our Risk, Residential Markets, IM and Operational “We needed a rapid implementation of a new digital customer experience that could securely manage Excellence teams collaborated to move away from and protect member data. The solution exceeded everyone’s expectations. The Cinchy platform lets us manual reporting toward fully automated risk and deliver an end-to-end COVID-19 relief solution, not just window dressing, We were surprised at how compliance monitoring and reporting.” quickly we were able to automate manual and legacy systems across our 35 credit union partners.” Cammy Ouellette, Senior Director Analytics Jim Vibert, Director of Business Transformation

Cinchy Page 8 Page 10

Cinchy Page 8 Page 10